HOAC FOODS INDIA LIMITED Raises 1,000.00 Lakhs in Qualified Institutional Placement (QIP)

ANI PR Wire

04 Jul 2025, 14:00 GMT+10

PNN

New Delhi [India], July 4: HOAC FOODS INDIA LIMITED, a primarily engaged in the manufacturing and distribution of high-quality natural food products under the brand name "HARIOM", offering a diverse range that includes chakki atta (wheat flour), organic herbs and spices, unpolished pulses, grains, and cold-pressed yellow mustard oil, has successfully raised 1,000.00 Lakhs through its first-ever Qualified Institutional Placement (QIP). The QIP, launched on June 30, 2025, and closed on July 03, 2025, saw significant interest from investors, underscoring strong confidence in the company's strategic vision and market position.

HOAC Foods India Limited allocated 4,97,250 equity shares, each with a face value of 10, to qualified institutional buyers (QIBs) at an issue price of 201 per share. This pricing represents a discount of approximately 5.00% to the QIP floor price of 210.64 per share, as determined by SEBI regulations. The QIP was fully subscribed, reflecting the high demand and investor confidence in HOAC Foods India Limited.

Investors participating in this QIP include NINE ALPS OPPORTUNITY FUND, HOLANI VENTURE CAPITAL FUND, MILI CAPITAL INVESTMENT TRUST, PARADISE MOON INVESTMENT FUND I, MONEYWISE FINANCIALSERVICES PRIVATE LIMITED, SWYOM INDIA ALPHA FUND, CHANAKYA OPPORTUNITIES FUND 1, Beacon Stone Capital VCC - Beacon Stone I, SAINT CAPITAL FUND.

The proceeds from the QIP will be strategically deployed to accelerate HOAC Foods India Limited growth plans. These include funding working capital requirement for the expected rapid growth in the coming years.

Commenting on the fund raise, Mr. Rambabu Thakur, Managing Director said: "The overwhelming response to our QIP from investors is a testament to their trust in HOAC Foods India Limited vision and strategy. The successful completion of this QIP, marks a pivotal moment in our journey. The raised capital will fortify our working capital requirements and ensure to maintain robust growth momentum."

The Book Running Lead Managers (BRLMs) to the QIP issue were GYR Capital Advisors Private Limited.

"Mahek Sejwani from GYR Capital said, 'GYR Capital is proud to have successfully closed the QIP of HOAC India Ltd., marking yet another milestone in our association. From a successful IPO to scaling exports and now institutional fundraising, HOAC's journey reflects consistent growth and strategic execution."

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PNN. ANI will not be responsible in any way for the content of the same)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of South East Asia Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to South East Asia Post.

More InformationInternational

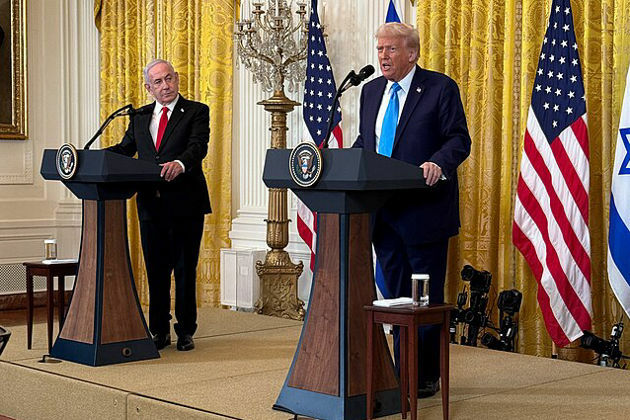

SectionWhite House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...

Over 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

US Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

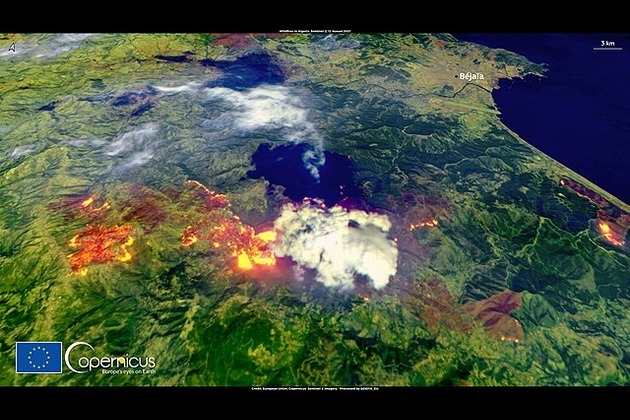

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Business

SectionGrammarly acquires Superhuman to boost AI workplace tools

SAN FRANCISCO, California: Grammarly is doubling down on AI-powered productivity tools with the acquisition of Superhuman, a sleek...

Standard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...