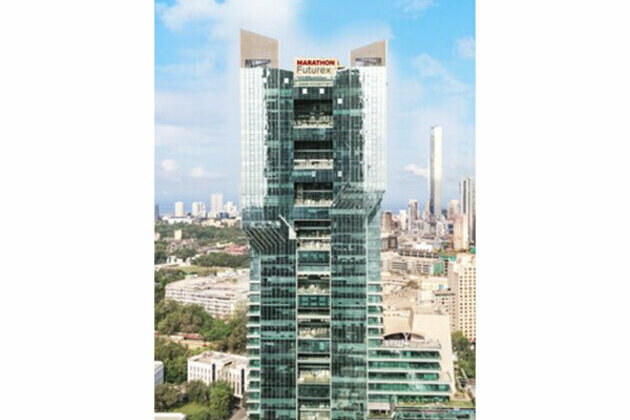

Marathon Nextgen Realty Raises Rs. 900 Crore Through Qualified Institutions Placement

ANI PR Wire

04 Jul 2025, 15:45 GMT+10

PRNewswire

Mumbai (Maharashtra) [India], July 4: Marathon Nextgen Realty Ltd (BSE: 503101) (NSE: MARATHON) ("MNRL"), one of Mumbai's leading real estate development companies, has successfully completed a Qualified Institutions Placement (QIP), raising Rs. 900 crore (US$ 105 million).

* Overwhelming Response from Premier Domestic and International Institutional Investors Validates Company's Growth Strategy

The QIP proceeds will primarily be used as growth capital, enabling the company to expand its development pipeline and invest in high-potential opportunities across the Mumbai Metropolitan Region. This capital infusion will further strengthen the company's financial foundation with its net debt-to-equity ratio expected to reduce further from the current 0.46 following the planned debt reduction.

The QIP was executed through the issuance of 1,62,12,406 equity shares at 555.13 per share (face value 5 each). The offering, which closed on June 30, 2025, attracted strong participation from leading institutional investors including Quant Mutual Fund, Kotak Alternate Asset Managers, and Samco Mutual Fund, among others.

This QIP has significantly enhanced MNRL's institutional investor base, with Foreign Institutional Investor (FII) holding increasing to 9.9% and Domestic Institutional Investor (DII) holding rising to 16.66% post-issue.

Management Commentary

Mr. Chetan Shah, CMD of MNRL, said, "This successful capital raise of Rs. 900 crore represents a decisive vote of confidence from marquee institutional investors in our strategic vision and execution capabilities. The Indian real estate sector is witnessing unprecedented momentum creating substantial opportunities for well-positioned players like MNRL. Our demonstrated track record of delivering projects on time, coupled with our strategic land bank and robust project pipeline, positions us exceptionally well to capitalize on this sector upswing.

Additionally, our recently approved amalgamation scheme--bringing promoter group entities and their assets under the MNRL--will consolidate our land bank, projects and inventory, creating an efficient operating structure with better corporate governance. We are at a strategic inflection point, equipped with the right capital, a robust asset base, and a clear long-term vision to drive the next phase of MNRL's evolution."

The complete Placement Document is available for detailed information

About Marathon Group

For over 53 years now, Marathon Group has been helping shape Mumbai's skyline. Founded in 1969 by Ramniklal Zaverbhai Shah, the Group has completed over 100 projects in the city with a portfolio encompassing townships, affordable housing, luxury residential, retail, small business spaces, and corporate parks. Marathon is design-driven and engineering-focused with a leadership team comprising of technocrats. Mr. Chetan Shah, Chairman & Mr. Mayur Shah, Vice-Chairman, have completed their engineering from US and the third generation of the company comprising of the three heads of projects -Mr. Kaivalya Shah, Mr. Parmeet Shah, and Mr. Samyag Shah are highly qualified having completed their education from US and bring decades of real estate experience. Marathon has strong in-house capabilities in design, engineering, execution, marketing, and sales, and prides itself on its transparency and customer-centricity. The Group has ongoing projects and land banks at Lower Parel, Byculla, Mulund, Bhandup, Thane, Dombivli and Panvel.

More information is available at https://marathon.in/nextgen/

Disclaimer

Some of the statements in this communication may be 'forward-looking statements within the meaning of applicable laws and regulations. Actual results might differ substantially from those expressed or implied. Important developments that could affect the company's operations include changes in the industry structure, significant changes in the political and economic environment in India and overseas, tax laws, duties, litigation, and labour relations.

Photo: https://mma.prnewswire.com/media/2724344/Marathon_Futurex.jpg

Logo: https://mma.prnewswire.com/media/2620435/Marathon_Logo.jpg

(ADVERTORIAL DISCLAIMER: The above press release has been provided by PRNewswire. ANI will not be responsible in any way for the content of the same)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of South East Asia Post news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to South East Asia Post.

More InformationInternational

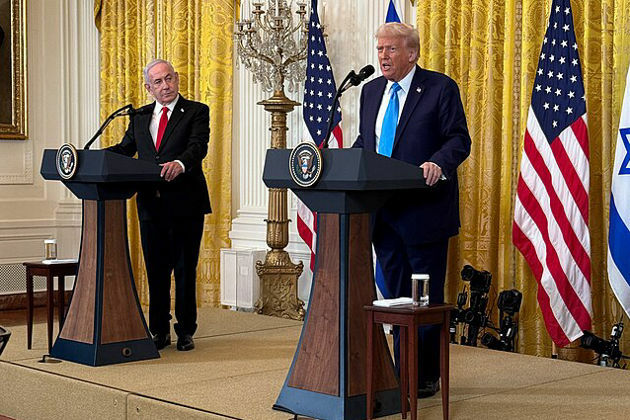

SectionWhite House meeting between Trump, Netanyahu on July 7

WASHINGTON, D.C.: President Donald Trump will meet Israeli Prime Minister Benjamin Netanyahu at the White House on Monday. President...

Over 60 companies named in UN report on Israel-Gaza conflict

GENEVA, Switzerland: A new United Nations report alleges that dozens of global corporations are profiting from and helping sustain...

UK lawmakers desigate protest group as terrorist organization

LONDON, UK - Lawmakers in the United Kingdom have voted overwhelmingly to proscribe the direct-action group Palestine Action as a terrorist...

Dalai Lama to address Buddhist conference, reveal succession plan

DHARAMSHALA, India: The Dalai Lama is set to address a significant three-day conference of Buddhist leaders this week, coinciding with...

US Supreme Court backs Texas efforts to shield minors online

WASHINGTON, D.C.: In a significant ruling last week, the U.S. Supreme Court upheld a Texas law requiring age verification for users...

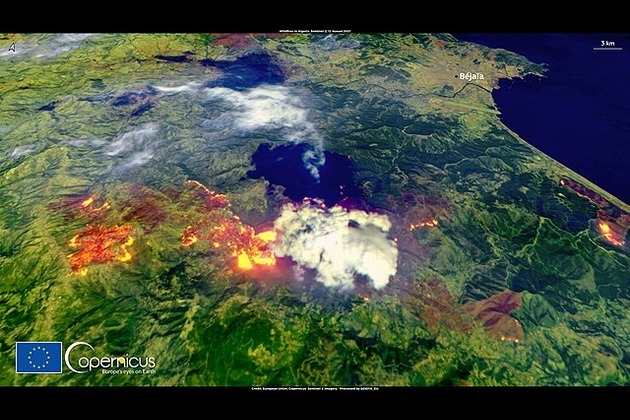

Turkey, France battle wildfires amid early Europe heatwave

ISTANBUL/PARIS/BRUSSELS: As searing temperatures blanket much of Europe, wildfires are erupting and evacuation orders are being issued...

Business

SectionGrammarly acquires Superhuman to boost AI workplace tools

SAN FRANCISCO, California: Grammarly is doubling down on AI-powered productivity tools with the acquisition of Superhuman, a sleek...

Standard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...